Navigating US healthcare reimbursement: taking digital health solutions to market

Navigating US healthcare reimbursement: taking digital health solutions to market

Healthcare reimbursement in the United States is complex. Understanding how money flows in this system is critical to navigating a route to market for your digital solution. Susan Xu is a healthcare reimbursement strategist and the author of “Healthcare’s Reimbursement Maze”, a book which decodes the structure of the US reimbursement ecosystem and its influence on which innovations succeed. In this article, Susan shares insights about this system and the factors influencing the adoption of new technologies.

How can digital health innovators break into the US market?

There are multiple ways to commercialise digital health solutions in the US. This landscape is constantly changing as new technologies become recognized as standard in clinical care. In this article, we’ll focus primarily on solutions that enable the delivery of medical services for which healthcare providers can obtain reimbursement from payers (public and private health insurance plans). However, this isn’t the only way to market your solution in the US. Digital health solutions are diverse in nature, and depending on what yours does, who the end-user is, and what benefits it delivers, you may end up selling to providers, payers, pharmaceutical companies, other healthcare companies, or directly to patients. That said, understanding provider reimbursement is essential to evaluate whether you can take advantage of this particular route to market, which may be the best path to widespread adoption for your solution.

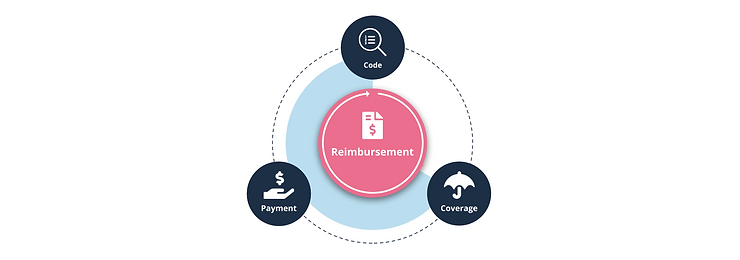

What is healthcare reimbursement?

Reimbursement is the payment healthcare providers receive for providing medical services. In the US, most services have traditionally been reimbursed on a fee-for-service (FFS) basis, meaning each service (each consultation, procedure, diagnostic test, etc.) or bundle of services provided is billed separately. Reliable payment for each service depends on several factors, including medical coding, rate setting, and coverage determination (more on each of these shortly).

What about the manufacturers of products used in patient care, including digital health solutions – how are they paid?

Under the traditional FFS model, companies typically sell their solutions to provider facilities (e.g., hospitals). Providers use the solutions to deliver billable services, for which they submit claims to payers (patients’ insurance plans). Under this model, companies don’t usually receive payment directly from payers for services provided. However, securing reimbursement for providers is critical to drive adoption at scale.

Provider reimbursement has traditionally been structured around care settings and provider types, rather than the technology used to deliver care. As such, there is no distinct reimbursement framework for digital solutions that separates them from non-digitally enabled services. Finally, to further complicate matters, various components of the reimbursement ecosystem are overseen by different organisations, connected at specific touchpoints.

Why is coding crucial?

Medical coding translates clinical concepts (e.g., diagnoses, procedures, equipment) into standardised numeric/alphanumeric codes used to track and share information. In the US, ‘reimbursement codes’ play a vital role in medical billing as they are used to create claims.

For new innovations, including digital health solutions used in patient care, it is desirable for products to be covered by one or more reimbursement codes. Depending on the context in which the solution is used, this may be critical to drive adoption by providers, as it means that using the product gives them a reliable source of revenue under the FFS reimbursement model.

For Software as a Medical Device (SaMD) solutions used in ambulatory care settings (e.g., physician offices, hospital outpatient departments), the most important code set is the Current Procedural Terminology (CPT), maintained by the American Medical Association. CPT codes are categorised into several groups. Category I is the largest, encompassing commonly used medical procedures and services. For novel innovations in patient care, obtaining a new Category I code is an important route to large-scale adoption, although this process is often demanding, typically requiring FDA clearance or approval, support from relevant clinical specialty societies, and established clinical efficacy through peer-reviewed publications.

Due to the rigorous requirements for Category I codes, many new SaMD solutions initially obtain Category III CPT codes, which are temporary codes used to report emerging technologies. Approval for Category III codes does not require FDA approval or proven clinical efficacy but merely having a relevance for research (ongoing or planned), or demonstrating the need for a service to be tracked to evaluate usage frequency.

Often, new solutions enable a procedure or service already covered by an existing CPT code. For example, if a company develops a new digital platform for remote monitoring, this will likely facilitate services covered by established CPT codes for remote physiologic monitoring (RPM) and remote therapeutic monitoring (RTM). In such cases, the existing codes can be used for billing by providers employing the solution. For developers, this means the path to commercialisation is potentially faster, and much less complicated. However, the existence of a relevant code also indicates that a payment rate has likely been established and there are already competitor solutions on the market. During reimbursement planning, key considerations include whether a code for a similar product exists and whether your product fits within the scope of an existing code. This informs whether a new code application is necessary or an existing code can be utilised.

How are payment rates determined?

Rate setting – determining payment rates for specific medical services – has become increasingly sophisticated. For example, Medicare – a public health insurance programme for the elderly – has more than 10 different payment systems for the reimbursement of services performed by providers across a range of care settings. These include the Physician Fee Schedule (PFS), Outpatient Prospective Payment System (OPPS) and Inpatient Prospective Payment System (IPPS). Private health insurers often use Medicare payment rates as a basis for price negotiation.

All of Medicare’s payment systems differentiate and quantify the relative prices of different services. Each system has its own analytical approach for setting relative weights, which serve as the basis for payment rate setting. For example, PFS rates are calculated using a formula that considers the amount and intensity of physician work, as well as clinical and nonclinical resources needed (incl. overhead and malpractice insurance costs).

Whether a new technology is eligible to receive separate payment depends on how the payment unit is defined within a payment system. For example, under IPPS, the payment unit is typically one hospital inpatient stay, covering nearly all services and procedures provided during that admission (incl. room and board, imaging, treatments, and ICU stays).

To assess the potential payment rate for a new SaMD product, it is essential to consider the care settings in which the product is used, the main healthcare providers involved, and the payment systems that will be used for reimbursement. Examining the applicable payment system will help clarify whether the product could receive separate payment (and what rates are set for similar technologies), or whether it would be bundled into other services.

How do health insurers decide whether to cover a new technology?

Coverage refers to policy specifying the terms and conditions under which public or private health plans will pay for a particular medical service. Coverage by payers is not guaranteed by having a code and payment rate. Obtaining coverage is crucial to ensure reliable payment for providers, and therefore to sell your solution to them. However, obtaining coverage is sometimes the most challenging step in this journey.

Most payers have established evidence-based approaches for developing coverage policies. For example, Medicare has issued several rules specifying the national coverage determination (NCD) review process and evidential requirements, as well as the local coverage determination (LCD) process managed by Medicare Administrative Contractors. Similarly, private health plans have their own technology assessment and policy development processes, which vary in terms of where evidence is sourced, how evidence is assessed, whether external expertise is engaged, and who is involved in decision making. Private payers also look to public payers’ policies to inform their own decisions, however this process can often be opaque. In any case, evidence demonstrating that a new digital solution is safe and has a positive clinical impact is pivotal in payer coverage decisions. Given the significant time and planning required for evidence generation and securing early adoption, it is advisable to assess early whether a new coverage determination is needed, or whether your solution can be covered under existing policies.

How can digital health developers navigate the US system and go to market?

Having a reimbursement strategy is essential. This is a plan of action to ensure your new technology can effectively reach the target patient population at the right price. In the early stages of product development, it is crucial to be mindful of major reimbursement barriers – understanding potential dead-end issues before committing to a course that may be difficult to reverse will save a lot of time and money. Reimbursement planning brings in the perspectives of payers, providers and patients, and helps to design a more marketable solution that delivers value for all of them.

For innovators seeking venture capitalist (VC) funding, it is important to assess whether there is a pathway to reimbursement, how quickly the solution can be reimbursed, and what the potential payment rates are. This information is vital for VCs to assess the value of your company and the associated investment risks.

When designing clinical trials for FDA approval/clearance, consideration should also be given to evidence requirements from payers and providers. Innovators should explore ways to gather necessary evidence efficiently and cost-effectively. As you approach regulatory approval/clearance, having a reimbursement strategy in place becomes crucial to expedite the commercialisation process. If new codes, coverage and/or payment applications are necessary, ensure that these are prepared and ready for submission before any relevant deadlines.

Prova Health supports digital health innovators with evidence generation and market access solutions. To discuss how we can support you, get in touch at hello@provahealth.com.

Susan Xu (Principal, WyDus LLC) is a healthcare reimbursement strategist, health policy researcher, and the author of a book called “Healthcare’s Reimbursement Maze – The Ecosystem Regulates Market Access to Medical Innovation in the US.” With over two decades of experience in medical technology, health policy, and healthcare reimbursement consulting, she is committed to facilitating faster and smoother market access for medical innovations in patient care. Susan holds master’s degrees in public administration and biomedical engineering.

Dr Des Conroy (Consultant, Prova Health) is a medical doctor with experience in roles across clinical practice, industry and consulting. He has supported the development, clinical validation and deployment of artificial intelligence-based Software as a Medical Device (SaMD) solutions around the world. He has led research into evolving evidence standards, evaluation methodologies and reimbursement models in digital health.